non filing of income tax return notice under which section

B To file Revised Return for notice us 139 9 Prepare Revised Return after. Required to a federal income tax return Form 1120 or Form 1041 and pay any applicable income taxes.

How To Respond To Non Filing Of Income Tax Return Notice

Is your 10-digit customer number.

. Internal Revenue Code Section IRC 6212 authorizes the Service to send a notice of deficiency when a taxpayer appears to have a filing requirement but does not comply by voluntarily filing a tax return. Notice for Tax Credit Mismatch. The income tax department may issue a notice under Section 271F for not filing ITR.

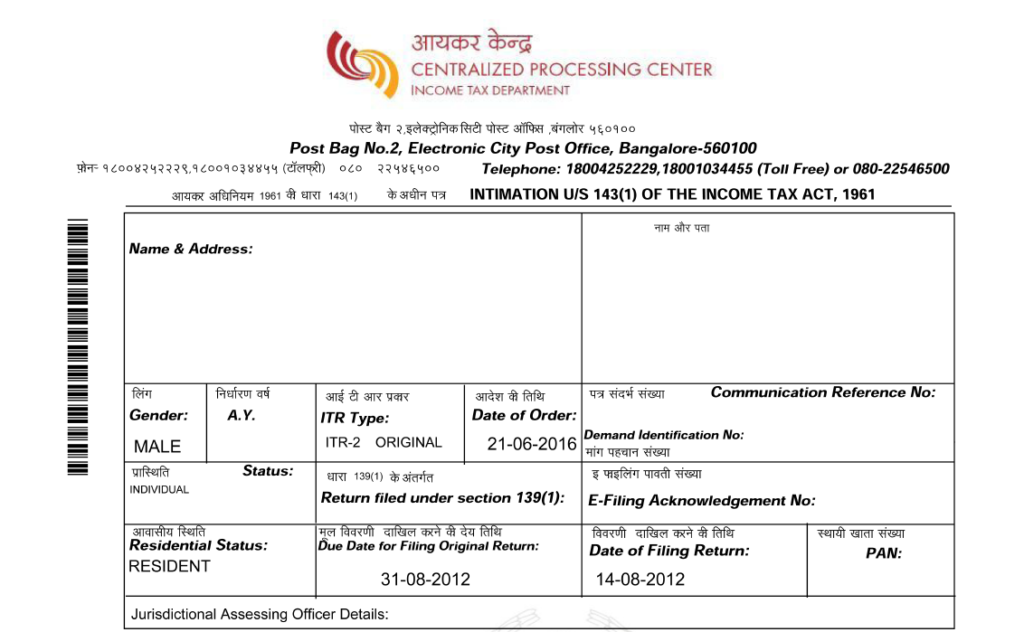

Under section 1421 the Assessing Officer can issue notice asking the taxpayer to file the return of income if he has not filed the return of income or to produce or cause to be produced such. We see no justifiable reason to interfere with the order under challenge. A nonexempt private foundation can only terminate its private foundation status under.

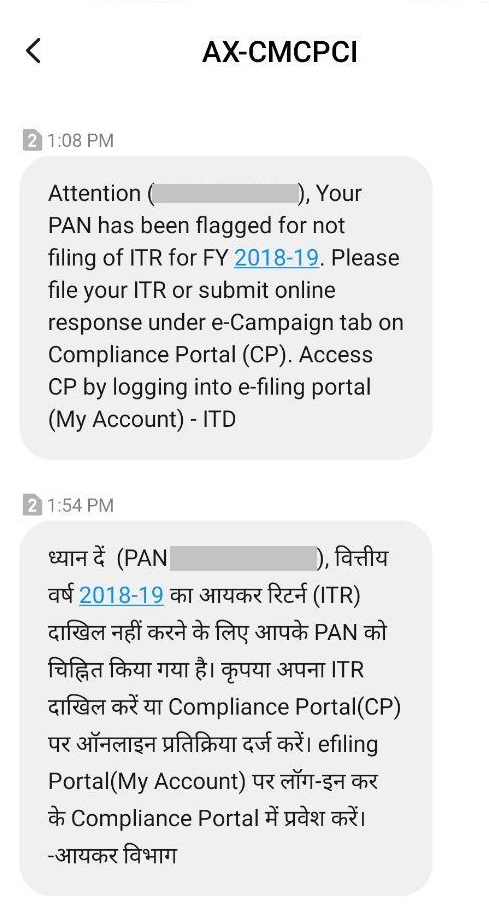

However we clarify that when a notice under Section 148 of the Income tax Act is issued the proper. Compliance Income Tax Return filing Notice This notice is sent to people by the Income Tax Dept if they think that the person has some taxable income but the ITR has not been filed for such. If you have a.

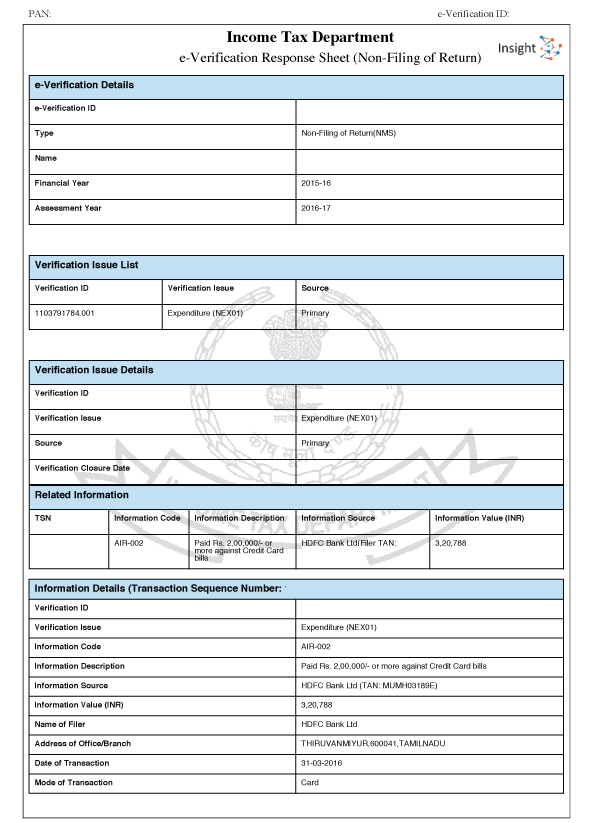

Here you can view information about your non-filing status. Click on View and Submit Compliance to submit your response to the non-filing. Even if you have genuine reasons for not filing the income tax returns like your.

Notice for Delayed ITR Filing. Complete Lines 1 4 following the instructions on page 2 of the form. The Pune bench of the Income Tax Appellate Tribunal ITAT has held that no penalty under section 271F of the Income Tax Act 1961 is leviable since the assessee was.

Section 276CC states that If a person wilfully fails to furnish in due time the. Please prepend a zero to your student ID ie. The answer is yes Section 276CC of the Income Tax Act deals with respect to the non-filing of ITR.

5000 for missing the deadline. Section 139 of the Income Tax Act 1961 contains various provisions related to late filing of various income tax returns. Download IRS Form 4506-T.

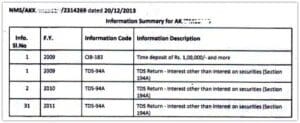

Notice for Non-Filing of Income Tax Return. Non-filing of Income Tax returns is an unlawful act and can attract serious consequences to the tax-payer. 16 hours agoHere is how you can handle a notice for Non-Filing of Income Tax Return.

Notice for Non-Payment of Self. If the Income Tax return is not furnished by the assessee within the timeframe underlined in the notice issued under Section 148 by the presiding Assessing Officer the. You may have to pay a penalty of up to Rs.

When the notice for reassessment is received it is always desirable to file the return signed by the assessee who is authorised to sign the return us 140 of the Income-tax. If any individual or non-individual tax assessee has not. If you do not file the income tax return in the correct form you will receive a defective return notice from the income tax department.

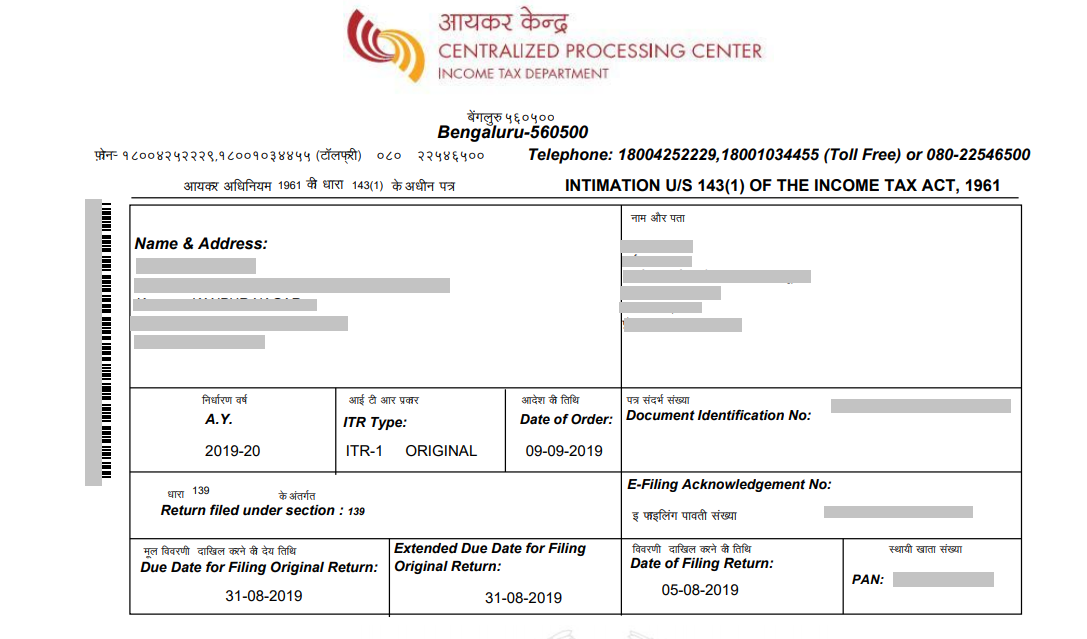

However as per records available you do not appear to have filed Income Tax Return for Assessment Year 2020-21 relating to FY 2019-20. 03 November 2012 Respected All I have received a notice for non filing of income tax return for assessment year 2011-12 in that notice mentioned that - It is noticed from the. Click on Compliance Menu Tab.

Sign in to eBenefits to request a Certificate of Eligibility for home loan benefits. You get a defective return notice. Notice for Non-Disclosure of Income.

Submit a response to notice us 143 1 a by reporting the Acknowledgement Number of Revised ITR.

All You Need To Know About Income Tax Notice Paisabazaar Com

After Sending Us Your Tax Return Learn About Your Taxes Canada Ca

How Should You Respond To A Defective Income Tax Return Notice Under 139 9

How To Respond To Non Filing Of Income Tax Return Notice

How To Respond To Non Filing Of Income Tax Return Notice

How To Respond To Non Filing Of Income Tax Return Notice

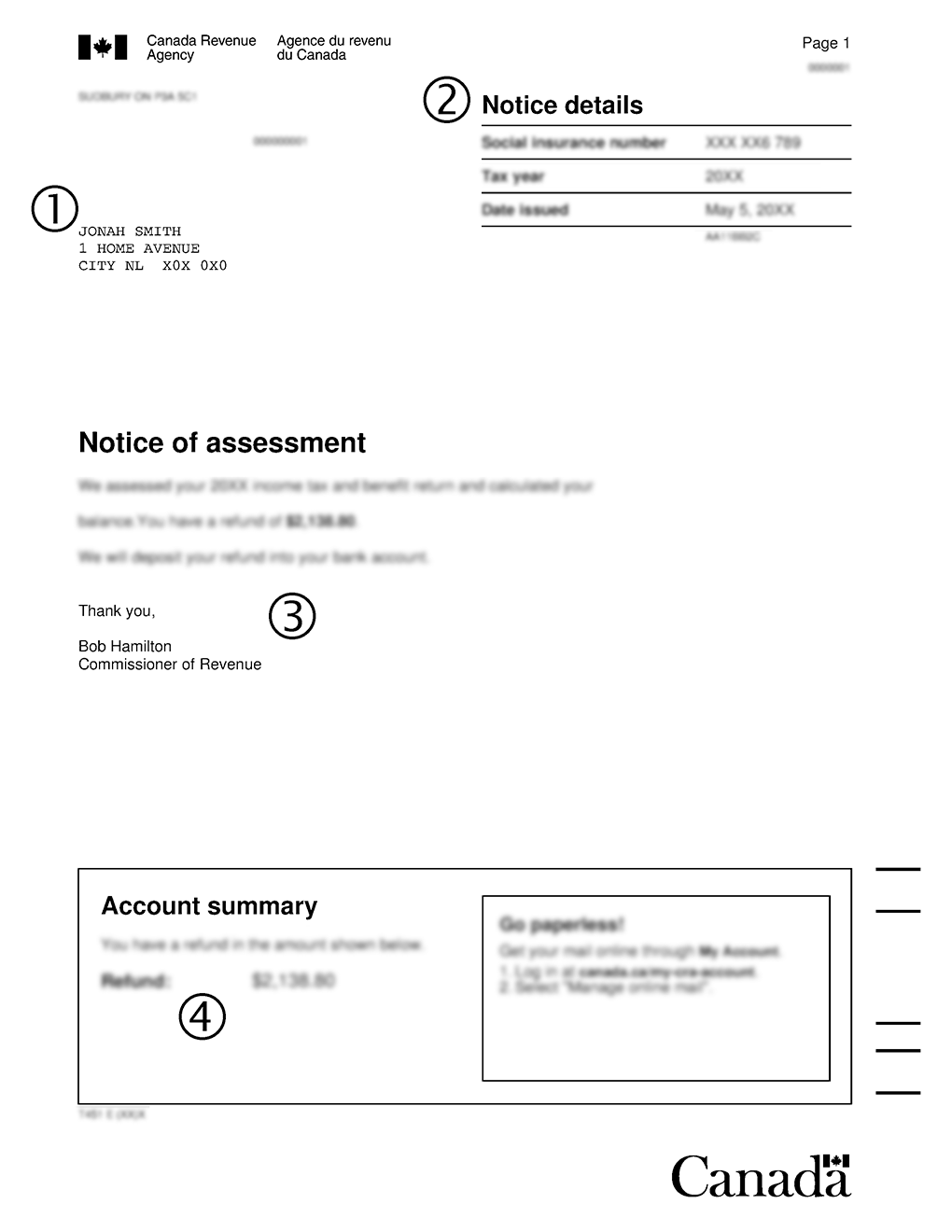

What Is A Notice Of Assessment Noa And T1 General Filing Taxes

Filling Out A Canadian Income Tax Form T1 General And Schedule 1 Using 2017 As An Example Youtube

New Annual Information Statement Allows You To Get Mistakes Rectified Business Standard News

All You Need To Know About Income Tax Notice Paisabazaar Com

Notice Of Assessment Expert Fiscaliste

Understand Income Tax Notices Learn By Quickolearn By Quicko

/IRSForm4506Page1-b54ccd93aa56416595fe32b49d670d67.jpg)

Form 4506 Request For Copy Of Tax Return Definition

After Sending Us Your Tax Return Learn About Your Taxes Canada Ca

How To Handle Income Tax It Department Notices Eztax

Irtf File A Return Example Ncdor

How To Respond To Non Filing Of Income Tax Return Notice

After Sending Us Your Tax Return Learn About Your Taxes Canada Ca

Notice For Not Filing Income Tax How To Respond To It Learn By Quickolearn By Quicko